A decade and a half has elapsed since the bursting of the late-2000s housing bubble, a cataclysmic event that triggered the Great Recession and sent shockwaves through the global economy. Today, the real estate market and the broader economic landscape have displayed a remarkable recovery, exhibiting resilience in various ways. However, a critical challenge looms large in the form of affordability, prompting a pertinent inquiry into the current health of the housing market and its sustainability before the possibility of another recession emerges.

Projections indicate that U.S. home prices are poised to persist in their gradual ascent, even in the face of higher interest rates that have remained elevated all year. The resilience of this trend suggests that the housing market is not easily swayed by high rates alone. This phenomenon contributes to a substantial decline in inventory, as potential sellers, having secured favorable rates during the pandemic housing rush, hesitate to enter the market. Additionally, the number of foreclosures remains low, the job market has been robust, and the Federal Reserve’s efforts to navigate record inflation further bolsters the overall economic landscape. The scarcity of available homes on the market helps explain the persistence of home prices despite the challenging affordability landscape. From January through November of this year, nearly 160k homes came onto the market in Southern California, almost 40% below the three-year average from 2017 – 2019 from almost 260k homes.

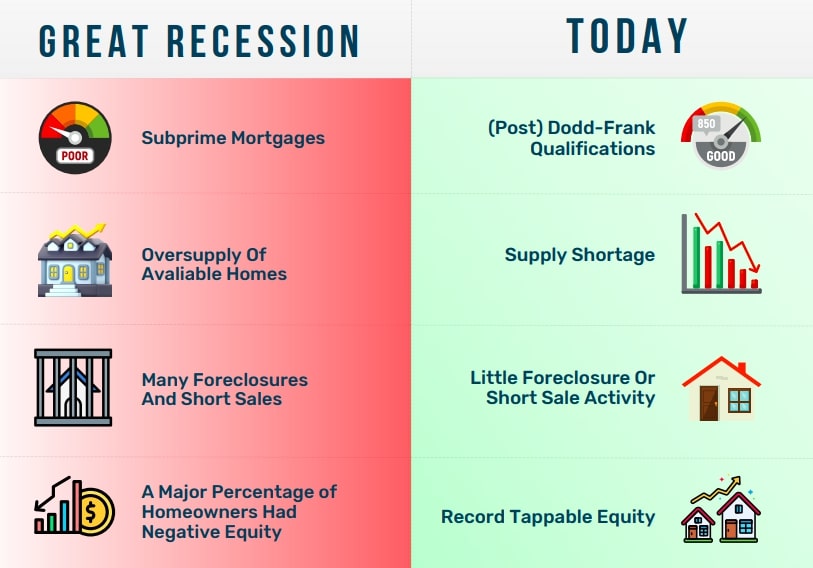

In contrasting the present-day scenario with the late-2000s housing crash, a pivotal distinction arises in the form of the subprime mortgage crisis, which fueled an artificial surge in housing demand. Unlike that era, today’s housing market exhibits fewer echoes of these issues, with the supply-demand dynamics shaped by different factors. However, the lingering concern centers around affordability, exacerbated by the persistently high-interest rates.

Homeowner equity has emerged as a key indicator of the market’s health. Following the housing bubble’s collapse in 2007, home values experienced a sustained decline over the subsequent years, bottoming in the first quarter of 2012 at a cycle low of $17.9 trillion for the total value of the singlefamily housing market stock. This downturn was exacerbated by many homeowners acquiring mortgages when property values were significantly higher, leading to a considerable accumulation of household debt. At that juncture, with $9.7 trillion in outstanding debt, homeowners’ equity plummeted to 45.9%, marking its lowest point in records dating back to the early 1980s

In the 11 years since, however, the real estate landscape has dramatically transformed. Home values have more than doubled, with the single-family housing market reaching an impressive worth of $41.2 trillion by the first quarter of this year, representing a staggering 129% increase from the 2012 low. Intriguingly, the growth in mortgage debt has not mirrored this surge, registering at less than a third of its 2012 counterpart. This resurgence in homeowner equity underscores the resiliency and recovery of the real estate market, emphasizing a positive trajectory and stability not witnessed in decades.

Despite the affordability challenges, our perspective remains optimistic. The current trajectory does not signal an imminent collapse of home prices. Instead, we anticipate a gradual upward trajectory underpinned by various market dynamics and the intricate cross-section of interest rates, inventory, and affordability. The chart below exemplifies four distinct differences in today’s housing market compared to the Great Recession.